【Event Report Vol.2】Chiba Dojo × DRONE FUND|First Joint Pitch

Overview

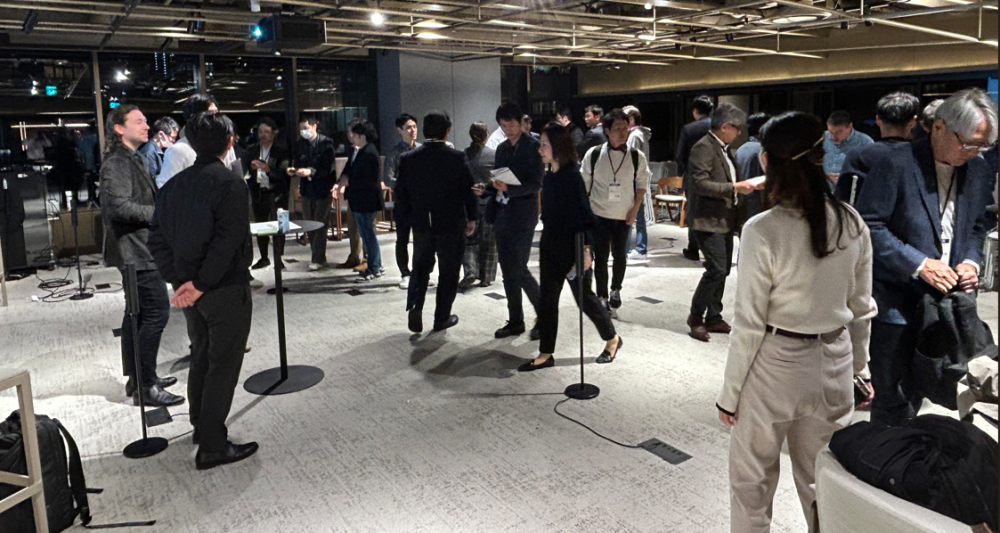

On 4 November 2025, we co-hosted the “Chiba Dojo × DRONE FUND|First Joint Pitch” event with Mori Building Co., Ltd. and Chiba Dojo Co., Ltd. at the Tokyo Venture Capital Hub (Azabudai Hills Garden Plaza B). The audience consisted primarily of CVCs and corporate participants, with approximately 30–40 attendees.

Tokyo Venture Capital Hub: https://www.azabudai-hills.com/tokyo_vc_hub/index.html

ㅤ

ㅤ

Intent of This Event

Recognizing challenges in corporate–startup collaboration

Conventional pitch formats often fail to sufficiently communicate a technology’s core value or applicable domains, resulting in stalled internal evaluations.

Lead times from consideration to implementation are particularly long in deep tech and hardware sectors.

Design Philosophy

The recommended comment format for presenting companies clarified what to focus on, reducing the cognitive load for attendees.

GP follow-up sessions highlighted each company’s key selling points and the investment rationale from an investor’s perspective.

In addition, Kotaro Chiba, General Partner of both Chiba Dojo Fund and DRONE FUND, provided questions from a different angle to further sharpen the audience’s understanding.

These measures ensured that networking began only after key discussion points had been aligned, creating an environment conducive to meaningful, high-quality dialogue rather than simple business card exchanges.

Intended Effects

Reducing Lead Time to Proof of Concept (PoC): Establishing a shared language at the initial touchpoint reduced the number of iterations required to define requirements.

Facilitating Internal Consensus Building: The aligned key points in the recommendation comments made it easier for attendees to explain the concepts within their own organizations.

ㅤ

ㅤ

Presenting Companies

Four companies presented—two funded by Chiba Dojo Fund and two funded by DRONE FUND.

Asobica (Chiba Dojo Fund portfolio): Customer community-building SaaS

https://asobica.co.jp/

Panalyt (Chiba Dojo Fund portfolio): Human capital data integration and analytics SaaS

https://panalyt.com/

MadeHere (DRONE FUND portfolio): Manufacturing platform

https://www.3dpc.co.jp/

Aising (DRONE FUND portfolio): Control system AI

https://aising.jp/

ㅤ

ㅤ

Key Features of the Event

Pre-distributed “Recommendation Comments”

A document summarizing each company’s key points, anticipated use cases, and potential collaboration entry points was shared in advance. This accelerated participants’ understanding and deepened the subsequent Q&A.

GP follow-up and Kotaro Chiba’s “deep dive” immediately after each pitch

Following each pitch, GPs from both funds provided supplementary insights from technology, market, and implementation perspectives. Kotaro Chiba then led a business deep dive.

These sessions helped clarify essential considerations, advancing discussions toward the preconditions required for implementation and verification design

ㅤ

ㅤ

Impressions of This Event and Future Events

The event maintained a consistently high level of enthusiasm—so much so that the room temperature was lowered twice during the session. Many attendees stayed in the venue even after the scheduled end time.

Our next event will be held on Tuesday, 2 December, featuring a joint pitch with University of Tokyo Edge Capital Partners

〈Contact for Inquiries〉

DRONE FUND Inc.

Mail: info-nrply@dronefund.vc